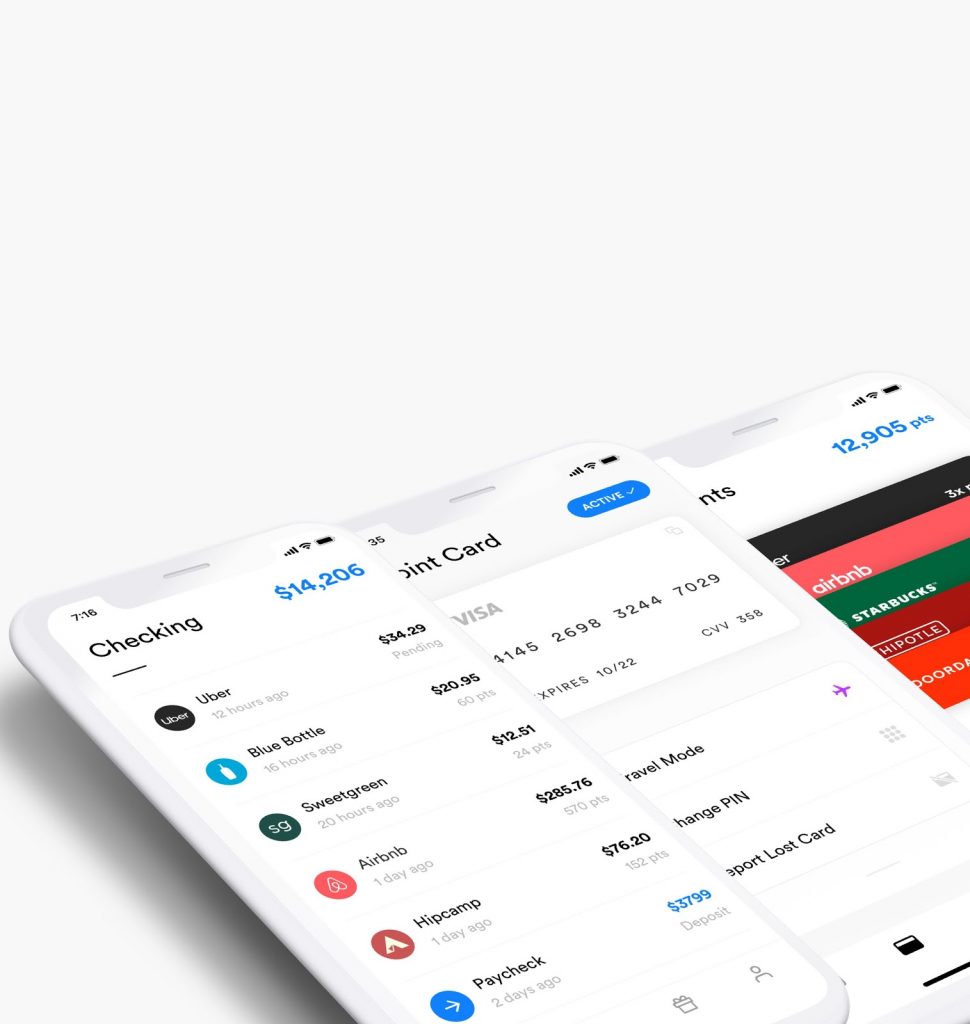

Point Bank

We are all aware of challenger banks that have been trying to make their mark in the US. The N26 banners have arrived in San Francisco with Monzo and revolut following suit later this year.

With feature sets including splitting transactions, transparent loans, early pay, free ATM withdrawals it can be hard to stand out.

Point, however, has a concrete business model whilst being able to offer users tremendous perks on many of their everyday purchases. If one compares the retailers this relatively new bank is offering perks for to N26, your jaw will drop.

Here you go, are you ready? 4x points on Coffee shops, 2x points on Airbnb, 3x points on Uber, Lyft, 3x points on food delivery and a whopping 7x points on subscriptions including Netflix and Spotify.

These kinds of rewards are unheard of with any bank you are looking at using. By redeeming these points within the app your future transactions will now be cheaper. With Point relatively new on the scene who knows what is on their roadmap.

Source: https://point.app

Pocket Points: Student Rewards

An app with a moral compass. Pocket Points give you, well… points for not opening your phone during class. They would be more than happy if you didn’t open their app.

We live in a time of evolving distractions from Instagram to TikTok to Snapchat; you can imagine what teachers are having to deal with in their classrooms.

What makes the app even more addictive is the social aspect. You are motivated by how many points others in your area are doing. There is no downside here. With more attention to the teacher, you are learning more! Who says you can’t get paid to learn?

Businesses who work with Pocket Points are also benefiting hugely. They can give away discounts to those with points which costs these businesses nothing. In return, they get a lot of exposure to their demographic without having to do any manual work at all.

Yelp

An app to check the reviews of the local pizza joint? Why would they reward me? I know it might sound intuitive that they would reward you but Yelp gives 10% cashback on many of the restaurants you are reviewing.

Just like that, you could be sitting in a restaurant having already a great meal only to get 10% cashback on it as well! You won’t be disappointed.

Source: https://yelp.com

Dave

I know what you are thinking, “Dave is huge, we know what they do!” Yes, you are correct, Dave is a new challenger with a very nice incentive to download. $100 fee-free overdraft. However, this is not the feature on Dave I wish to explore with you guys today.

Dave has an interesting feature that helps you find work if you are in need. Many of these are gig jobs so you would not require you to go through any rigorous application process.

This is a beautiful alternative to a loan forcing users to work a little extra to stay above $0. One can imagine how perfect this would be for any young professionals to students who have free time at any point during the week who are looking for either experience or a quick buck.

What makes Dave a neo/challenger bank here, is that even though the loan would be a better business decision, they know how hard loans can be on people if they are unable to pay them back and present a priceless alternative. If users have already taken out a loan, then this will aid them also by finding them quick, flexible work they can use to pay the loan back faster. Genius.

Source: https://dave.com

About the Author:

Landon is the cofounder of YSplit. You’ll find him typing away in a Starbucks on his blog at https://www.ysplit.com/blog