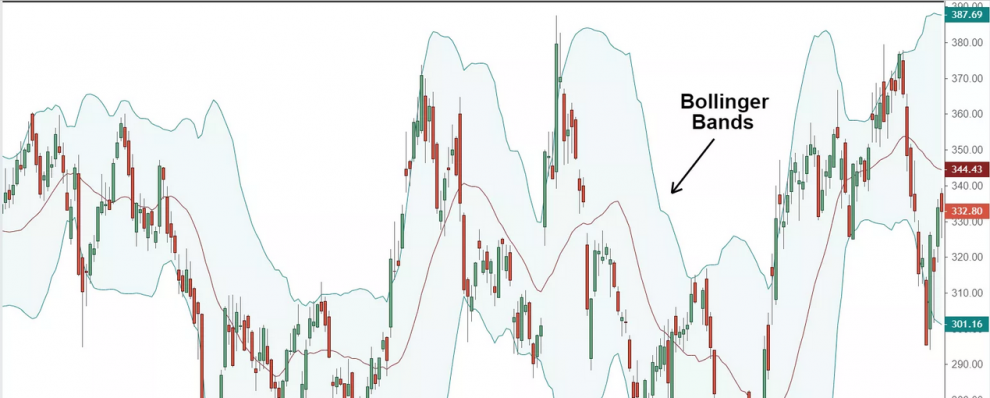

The preferred Bollinger Bands strategy Olymp settings consist of a 20-period simple motion medium for the medium band and two conventional differences along each center band. The goal of Bollinger Bands strategy Olymp is to quantify price volatility by the relative sense of ups and downs. The processing power is increased by unstable rates and reduces with reduced volatility.

For dealers to improve place themselves on the industry and under all market situations, the Bollinger Bands strategy Olymp is useful. The Bollinger Bands strategy Olymp benefit is that it enables traders to identify price data from the low to the high strips.

Oscillator Stochastic

The Stochastic oscillator’s security settings are 14-period. The percent K line generally shows a solid line, which is a simple 3-period percent K moving averages. The percent D line usually appears as a dotted line to serve as a warning. The Stochastic varies from 0 to 100 vertical scales. I tend to use both K and D lines by using the Stochastic. The underlying hypothesis is that it doesn’t monitor volume but tracks the velocity of price movement.

Furthermore, when the cost is near its top during an upward trend, the oscillator is on top of the price. On the other hand, if the price is above its lower, the oscillator appears to be less readable. This means that security has been oversold.

Nonetheless, the etiquette may be quite misleading, considering that overbuilt prices do not imply that prices should decrease instantly, while oversold’s prices should not, of course, be regarded upside down. The’ oversold’ terms will be used when rates are traded close to the peak or through the of the chosen period, however in this case, within 14 days. The long-term impact of this position can be.

Using the Price Action, Indicators, and Timeframes

Many engineers will use Bollinger Bands strategy Olymp or Stochastic to make their trade decisions a simple process. I can not see it as a fault, but it has a different point of view from which to analyze price action by using a solitary indicator to resolve a trade decision. The technical indicator is composed of several data points calculated by the price data of a security set up a specific formula. Any signal or indicator of what could happen later is merely a probability, not an assurance.

Hence, traders can adjust the chances on their side using quantitative analysis, and some significant factors and price movement here could become the main indicator. Furthermore, for short-term price motion analysis, technical measures have been created. Consequently, I use Bollinger bands strategy Olymp to identify high possibility points of entry and exit. I often switch to lower deadlines to identify these entrances and exits.

There are each trading techniques in each particular market. The dealer must configure the currency system set-up, diagram timeline, indicator, etc. which is the most appropriate on the market, during the production of a currency system. This implies how each trading market has the security settings for this particular market and that such settings are adapted when the system is exchanged in various markets.

Use Bollinger Band strategy Olymp and Stochastic to extend a theory

As has been stated, price measures are the best measure, as is the have to evaluate the timescale, and determinant settings mainly match our trade system and also to define them. All in all, we will blend all three to achieve the best results. The Stochastic indicator identifies speed and cost momentum and develop a potential price trend in combination with the Bollinger bands strategy Olymp, which automatically generates the measure of volatility. Moreover, I’m not going to reveal my hidden format through some illustrations below. Bear in mind that various variants are most efficient in a spa.

Interpretation – Setup of trade between bull and bear

The breaks of the higher Bollinger Bands strategy Olymp have been observed to be a way of taking advantage of over completed conditions. In general, the price of safety should fall underneath the higher strip and shift and towards the center strip once the higher strip has broken down caused by heavy buying. I based my approach on this concept, but I use Stochastic as a catalyst for confirmation of my trading setup.

Conclusion

As I have all addressed, Bollinger Bands strategy Olymp should not be used as an indicator for signal generation but should be combined with an additional indicator where it is incredibly useful. Therefore, I love to use Bollinger Bands strategy Olymp and Stochastic jointly to produce possible transmissions, buy them and sell them. It is also important to stress that price action is the basic technique of trade, which makes me instead of relying on a specific indicator to read the market by making informed purchasing decisions based on the real price action. Several Bollinger band strategy Olymp strips and Stochastic strategic tactics exist.